Shopaholic

You know that rush you get when you click “Add to Cart”? Or that little thrill when your package finally arrives? It’s not just excitement — it’s chemistry.

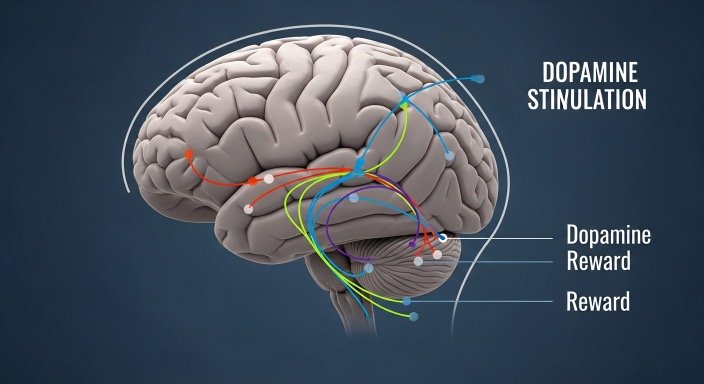

That buzz is your brain’s reward system lighting up, releasing dopamine, the feel-good chemical linked to pleasure and motivation. For most people, it fades after checkout. But for some, the craving doesn’t stop — it becomes a cycle of emotional relief followed by guilt. That’s when shopping crosses from habit to compulsion.

If you’ve ever asked yourself, “Why can’t I stop buying things I don’t need?” — this article is for you. Let’s explore what really happens in a shopaholic’s brain, how emotional triggers fuel overspending, and the science-backed steps to break free from it.

An article from National Library of Medicine defines compulsive buying disorder as “a chronic, repetitive purchasing behavior that becomes difficult to control.” It’s not just about materialism — it’s about soothing emotions.

Why Shopping Feels So Good: The Dopamine Effect

Shopaholic

Shopaholic

Your brain loves rewards. Every time you make a purchase — especially something new or exciting — your brain releases dopamine. This chemical motivates you to repeat actions that feel good, whether it’s eating chocolate, getting likes online, or buying something shiny.

But here’s the catch: dopamine doesn’t reward you for having — it rewards you for wanting. So the excitement peaks before you buy, not after. That’s why the satisfaction of shopping fades so quickly — the “high” is in the chase.

The Linked in reports that people prone to impulsive behavior have hyperactive dopamine systems. In other words, the reward center in a shopaholic’s brain fires more intensely, making it harder to resist spending.

This explains why sales, discounts, and “limited time” deals feel almost irresistible — they intensify the dopamine surge.

If you’re curious how positive reinforcement rewires thought patterns, check out Positive Affirmations for Self Love – Reprogram Your Mind — it explains how repetition shapes behavior and emotion.

Shopaholic

Emotional Triggers: Why We Spend When We’re Sad or Stressed

For many, overspending isn’t about the product — it’s about emotional escape. When you’re anxious, lonely, or bored, shopping becomes a temporary distraction that numbs discomfort.

Researchers at the NIH found that negative emotions increase impulsive buying by up to 30%. People subconsciously use spending to regulate mood — a concept known as “retail therapy.”

But here’s the problem: retail therapy creates a loop of emotional dependency.

- You feel bad.

- You buy something to feel better.

- The relief fades.

- You feel guilt or regret — and start over.

It’s a psychological feedback loop — a short-term fix that strengthens the long-term problem.

To start breaking the cycle, it helps to identify your triggers. Ask yourself:

- Do I shop when I’m anxious or lonely?

- Do I buy things to feel accomplished or validated?

- Do I hide purchases or feel guilty afterward?

Recognizing the emotion behind the urge is the first step toward control.

Read our article: The Hidden Anxiety Behind Every Shopaholic Swipe — explores how unprocessed emotions drive compulsive buying.

The Brain’s Reward Pathway: Addiction Without Substances

Compulsive buying activates the same brain regions as substance addiction — the nucleus accumbens (reward center) and prefrontal cortex (impulse control).

The American Psychiatric Association classifies compulsive shopping as a behavioral addiction, similar to gambling or internet addiction.

In both cases, the brain craves the “rush” and gradually builds tolerance — meaning you need to buy more frequently or spend more money to feel the same satisfaction.

This also explains the emotional crash after the purchase — a dopamine “drop” that mimics withdrawal symptoms.

For some, that crash triggers shame and secrecy — hiding receipts, deleting emails, or lying about spending. But secrecy feeds the addiction, creating isolation that deepens emotional distress.

Therapy, mindfulness, and accountability can help retrain this neural pathway — turning short-term relief into long-term healing.

The Role of Social Media and Advertising

Let’s be honest — we live in an economy designed to keep us shopping.

Algorithms track our preferences, influencers showcase “must-haves,” and companies use dopamine-driven marketing to target emotional needs. Every “limited drop” or “exclusive discount” is a psychological tactic designed to trigger urgency.

Gen Z and millennials face heightened stress due to social comparison online — and often use spending as a form of self-soothing.

Digital marketing exploits FOMO (fear of missing out) — the same mechanism behind social anxiety. When you see others showing off purchases, your brain registers “belonging through buying.”

Breaking this conditioning starts with awareness: recognizing that emotional spending isn’t personal failure — it’s a learned response to manipulation.

To explore how Gen Z is reclaiming identity through mindful self-expression, read Gen Z Haircuts and Mental Health: How a New Look Can Heal Confidence.

The Emotional Cost of Overspending

The short-term happiness of shopping often comes with long-term stress — especially when debt piles up.

Financial anxiety can lead to sleeplessness, shame, and avoidance, which in turn worsen mental health. The National Library of Medicine highlights that chronic money-related stress increases risks of depression and relationship tension.

This creates a paradox: shopping provides emotional escape from stress — yet also creates more of it.

A study in Psychiatry Research found that 90% of people with compulsive buying habits report feelings of guilt or emotional exhaustion afterward. These emotions reinforce the cycle, linking spending directly to self-worth.

If this sounds familiar, know this: it’s not about lack of discipline. It’s about an emotional need that’s being filled the wrong way.

Signs You Might Be a Shopaholic

You don’t have to be in debt to have a problem. Here are psychological and behavioral signs of compulsive buying:

- Shopping for emotional relief, not necessity

- Feeling anxiety, guilt, or shame after purchases

- Hiding spending from loved ones

- Buying things you never use or forget you own

- Using shopping to “reward yourself” frequently

- Feeling restless or low when not buying

If these resonate, consider it an invitation to reflect, not a reason for shame. Awareness is progress.

How to Stop Overspending: Science-Backed Strategies

Shopaholic

Shopaholic

Let’s shift from understanding to action. Here’s how to calm the impulse and retrain your brain.

1. Practice the 48-Hour Rule

Before any non-essential purchase, wait 48 hours.

This short delay activates your prefrontal cortex (logic) and quiets the amygdala (emotion). By giving the brain time to cool off, you turn reactive buying into intentional decision-making.

2. Replace the Habit, Don’t Just Resist It

Instead of fighting the urge, redirect it.

When you crave that dopamine hit, try alternatives that offer smaller but sustainable boosts — journaling, exercise, music, or calling a friend.

Our post Beautiful Mental Health Tattoos to Inspire Healing shows how creative expression can channel emotion productively.

3. Identify Your Emotional Triggers

Start tracking what you feel before you buy — stressed, lonely, bored, or anxious.

Once you identify the trigger, you can replace the behavior with emotional regulation techniques like mindful breathing or affirmations.

See Positive Affirmations for Self Love – Reprogram Your Mind for daily affirmations that strengthen emotional resilience.

4. Unsubscribe and Unfollow

Out of sight, out of cart.

Unsubscribe from marketing emails, mute influencer accounts, and turn off shopping app notifications. Reducing exposure reduces temptation.

According to IJNRD, removing digital triggers cuts impulse purchases by 40%.

5. Create a “Mindful Money Plan”

Budgeting doesn’t have to feel restrictive — it can feel empowering. Allocate a realistic “fun money” amount per month. When it’s gone, stop buying.

Apps like YNAB or simple envelope systems can make this visual and rewarding. The act of managing money consciously gives back the control dopamine once provided through impulsive spending.

6. Consider Therapy for Compulsive Spending

Cognitive Behavioral Therapy (CBT) is highly effective for compulsive buying disorder.

A therapist can help you identify thought patterns that lead to overspending and replace them with healthier coping mechanisms.

If you’ve never been to therapy before, our guide How to Talk to a Therapist for the First Time will help you take that first step comfortably.

7. Celebrate Small Wins

Every time you resist an unnecessary purchase, acknowledge it. Reward yourself with non-monetary treats — a walk, music, or journaling.

Each win rewires your reward system, teaching your brain that discipline can feel just as good as spending.

Rebuilding Your Relationship with Money and Self Worth

Overspending isn’t really about money — it’s about emotion. When we tie self-worth to possessions, we enter a cycle of “I buy, therefore I matter.”

Breaking that belief means building internal validation — through relationships, mindfulness, and self-care, not transactions.

Cornerstone confirms that mindful awareness of spending triggers can reduce compulsive shopping behavior by up to 50%.

Changing your relationship with shopping means changing how you define happiness. It’s not found in a sale — it’s found in self-awareness.

Final Thoughts: Healing Beyond the Cart

Being a shopaholic doesn’t mean you’re greedy or irresponsible — it means you’ve found a temporary way to soothe emotions. The goal isn’t to shame yourself, but to understand the why behind the behavior and replace it with healthier coping tools.

Healing from compulsive spending isn’t about giving up joy; it’s about choosing joy that lasts.

You can still love fashion, enjoy treats, and express yourself — just without losing control or peace of mind.

At AllMentalIllness.com, we believe understanding your mind is the first step toward reclaiming your life.

Explore more on emotional healing through:

- Positive Affirmations for Self Love – Reprogram Your Mind

- How to Talk to a Therapist for the First Time

- Beautiful Mental Health Tattoos to Inspire Healing

Remember: you don’t need a shopping cart to feel full — you just need compassion and awareness.

Our Authority Sources

- National Library of Medicine

- Linked in

- NIH – spending to regulate mood

- American Psychiatric Association

- National Library of Medicine – money-related stress

- IJNRD, impulsing purchases by 40%.

- Cornerstone -mindful awareness